State of Play: Toy Trends on Display at London Toy Fair 2024

Resilience of the U.K. toy market evident at London Toy Fair, with licensed toys continuing to play a vital role in the market dynamics. Here, License Global looks at just a few trends from the show floor.

Despite the continued challenging economic conditions in the U.K. throughout 2023 reducing consumers’ discretionary spending power, the U.K. toy market demonstrated resilience, with a total value of £3.5 billion in sales. Although the market experienced a decline of 5% in value, consumers’ demand for toys remains strong, with several toy categories achieving growth.

The sector’s strength was evident across the show floor as The British Toy & Hobby Association (BTHA) and Circana, formerly The NPD Group, presented their annual industry insights at the 70th London Toy Fair.

The Strength of the Licensed Toys Market

Crucially, thanks to several high-profile blockbuster movies, licensed toys continued to play a vital role in the market dynamics of 2023. As License Global highlighted in its 2024 Global Toy Forecast, the trend of classic and long-standing intellectual properties taking both the box office and the toy aisle by force will continue, with the likes of “Barbie,” “Super Mario Bros. Movie,” “Teenage Mutant Ninja Turtles: Mutant Mayhem” and “Dungeons & Dragons” making a big splash in 2023. All these brands were highly visible all across the show floor.

The licensed toys sector reported sustained growth for the fifth consecutive year, with market share increasing to 32% from 26% in 2020, surpassing last year’s highest-ever market share by 1%. The market is expected to stabilize in 2024, with a greater emphasis on evergreen licenses and original toy brands.

Paddington in a Phone Box toy, Rainbow Designs, at London Toy Fair

Plush Toys, Games and Puzzles

Some of the most significant growth areas were in plush, games and puzzles and building sets, which all experienced notable growth within the U.K. toy market.

The plush toys market has flourished recently and was the strongest performing category of 2023, recording an 11% growth. IP from Hasbro, Marvel and Disney were prominent on the show floor from brands such as TY, Jazwares, Just Play, Sambro, Simba Smoby UK and Posh Paws.

Collectibles was another notable category, increasing by 3%, and were also very visible across the show, with Sambro, Bandai and KAP TOYS showcasing IP from Hello Kitty and Marvel, among others.

“With people facing difficult times financially, these figures are not surprising and are in common with many other similar consumer goods industries,” says Kerri Atherton, head of public affairs, BTHA. “The sustained growth in key categories, like plush, licensed toys, as well as growth in games and puzzles and building sets, illustrate continued strong demand for toys and illustrates the resilience of the U.K. toy market. Looking ahead to 2024, this shows there are opportunities for toy companies launching new and exciting products, with a focus on value for money and affordability a key trend.”

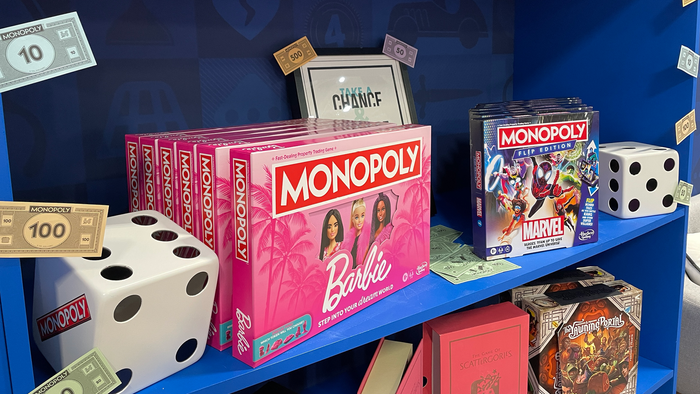

Board games continue to flourish since their rise in popularity in bringing families together during the pandemic. Asmodee, Ravensburger and University Games all showcased their extensive ranges of licensed titles in a category that is being driven by the rise of kidults, as adults seek playfulness and creative respite from their day-to-day lives.

Monopoly Barbie Edition and Monopoly Flip Edition Marvel, Hasbro, at London Toy Fair

Kidult, Nostalgia and Collectibles

The kidult toy market is now worth £1 billion, having contributed 28.7% of the U.K. toy market’s value, experiencing a 6% increase in growth in 2023. Notably, collectibles, building sets and games and puzzles are all categories that resonate with this demographic.

“The emergence of the kidult category as a growing consumer segment, contributing to over a quarter of the toy market’s value, is an exciting development,” says Melissa Symonds, executive director, UK Toys, Circana. “The report findings suggest that amid these challenging times, adults are seeking out escapism activities that tap into their childhood, evoking a more carefree time in their lives. This inclination towards toy categories that fulfill this need not only indulges their nostalgia but also positively contributes to their mental well-being.”

“The rise of the ‘kidult’ trend is more than the nostalgia of rediscovering your childhood,” says Gary Pope, co-founder, Kids Industries. “It’s far more interesting than that, and the products that have an impact in this category are rarely actually for children. This is about rediscovering the human need to play, and that has to be a very positive thing and a much-needed form of escapism. Toys for adults will only become more popular in 2024.”

Teenage Mutant Ninja Turtles Statues, Iron Studios, at London Toy Fair

Toy Trends for 2024 and Beyond

Affordability was a common thread on the show floor, with 15 of BTHA’s Top-27 hero toys priced under £25. The average selling price for toys saw a 2% increase, reaching £10.79. Notably, 63.5% of toy units were sold under £10, as manufacturers responded to the ongoing cost-of-living crisis, while only 2% of toys by volume were sold over £50, representing 13% of the market’s value share. In fact, sales of toys priced £15 to £20 were the only price category gaining sales.

Nostalgia was another trend that ran through many showcased products, including Rubik’s 50th Anniversary Retro Cube, John Adams Leisure and the Paddington in a Phone Box Soft Toy by Rainbow Designs.

“Innovation and newness are key drivers of growth, so we hope that 2024 will provide some exciting new products and fresh properties, perhaps even a craze or two that will continue to provide fun and excitement for little and the big kids who are just as interested in play,” says Symonds. “After all, we all deserve more fun in our lives, and toys provide much-needed escapism activities that tap into our childhoods, evoking a more carefree time in our lives.”

“Brilliant to see affordable toys really coming into their own,” says Pope. “It just makes sense that we make play as accessible as possible and drive volume. Those who can innovate and inspire imaginations for under £20 will continue to be the winners through 2024.”

Symonds said the “era of nostalgia” is here to stay and that the kidult trend will continue too. One thing she did note was that licensing will remain key across the board.

Watch: License Global at London Toy Fair 2024

London Toy Fair is running at Olympia, London, through Jan. 25.

Read License Global’s 2023 Global Toy Report on page 49 of December’s issue for further insight. You can also read the 2024 License Global Toy Forecast here.

About the Author(s)

You May Also Like