London's Toy Fair Gets Active

The mood at the London Toy Fair, held Jan. 24-26 and promoted by the British Toy & Hobby Association, was optimistic, having sold out in record time and with toys holding their own in a less than optimal economic climate.

April 6, 2018

The mood at the London Toy Fair, held Jan. 24-26 and promoted by the British Toy & Hobby Association, was optimistic, having sold out in record time and with toys holding their own in a less than optimal economic climate.

"We're remaining cautious because we expect the economic conditions to remain the same this year," says Lucy Wynn-Jones, head of licensing for Worlds Apart. "But last year has shown us that good toys, especially ones that meet the trend for staying at home, maintain their appeal and can lead to new opportunities."

The Year of Outdoor and Active Play

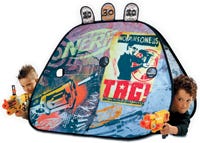

Also growing is the U.K.'s outdoor sports category, which includes active play items such as scooters, bikes and tents. Active play was a special focus at the London Toy Fair this year–this is London's Olympic year and the British Toy & Hobby Association's Make Time 2 Play campaign re-launches this spring with a focus on active play and its benefits. Outdoor toys, and more particularly preschool outdoor toys, represent an opportunity for licensing as the market is growing but not yet well penetrated by licenses.

The U.K. outdoor sports category was valued by The NPD Group at £350 million in 2010 and represents 12 percent of the toy market. It has grown 10 percent over the last year. It's a market that is dominated by generic brands and mid-age ranges such as Razor (the scooter brand grew 300 percent in 2011) and Hasbro's Nerf (NPD's No. 1 rated toy brand in sports and games in 2011, according to Hasbro). In the preschool segment, the dominant generic brand is Mookie Toys' range of Smart Trikes. But, as some manufacturers are finding, there are benefits and opportunities to be had from working with a licence.

For preschool age children, licenses are driving the growth. Thomas the Train, Peppa Pig, Ben 10 and Star Wars all featured strongly in 2011.

"Key classic licences are providing the growth," says Phil Ratcliffe, sales and marketing director of MV Sports. "When a licence 'fires' it tends to eclipse everything else and results in exponential turnover."

Wynn-Jones says licensed products represent about 40 percent of the pop-up toy market.

"Licenses help to maintain margins and drive innovation, which is important with so many brands competing in the market," she says. "Characters give us a reason to incorporate role play features into the products, extending the time spent playing with them and giving them longer-lasting appeal."

The pop-up and play tent segment is dominated by preschool brands but the category is proving it has potential for wider appeal.

"Taking the Nerf license from Hasbro has widened our target beyond preschool to include older boys," says Wynn-Jones. "We designed a Nerf pop-up tunnel with holes you can shoot your Nerf blasters through and it's been a huge success. It will be the No. 1 license for 2012."

The key, she says, is understanding how children play and finding the right structure for the age profile and play pattern. For preschool and girls, Wynn-Jones suggests it is more important to build role play features into products that are an actual, physical place such as the Disney Princess castle. For boys, it is about creating an environment where they can act things out.

Producing three or four designs under each license for different retailers has helped licensees create differentiation and grow the outdoor market.

"So many categories can become commoditized and with generic product it is possible to get to lower price points," says Wynn-Jones. "But with licensed products you have to focus even more on design because the item has to reflect the brand."

Not every brand is suited to outdoor toys and there are very strong brands in the market to go up against.

"You need strong entertainment and a strong existing toy line," says Ratcliffe. "Children must be able to be immersed in the property and for it to be their absolute favorite because while you may have a wide variety of toys, you tend to only have one scooter, one bike, etc."

Looking ahead, Silvergate Media's Octonauts is expected to grow within the segment this year, along with Disney's Minnie Mouse and HIT's Mike the Knight, each in the preschool market. Worlds Apart predicts continuing success for Nerf and a strong year for Spider-Man.

The popularity of outdoor and active toys is hardly new. Worlds Apart started making pop-ups 14 years ago for Chad Valley, the Woolworths toy brand. But in the last few years active play has become a broad social concern and a consumer trend echoed by Warner Bros.' pan-European deal linking Looney Tunes Active to own-label food lines at Super U. Active toys have been supported and promoted by the British Toy & Hobby Association, the government and others which has helped increase consumer awareness and interest. But the arrival of the Olympics is a double-edged sword. Inspiring and sporty it might be, but it will also take valuable shelf space away in retail channels such as the grocers. With licenses helping, there will be plenty to tempt retail again when the games are over.

London Toy Fair Highlights

Brands created jointly between entertainment companies and toy companies continue to proliferate, predominantly in the boys' action category. Monsuno from FremantleMedia Enterprises and Jakks Pacific and Redakai from Marathon Media and SpinMaster are just two examples. Elsewhere Hasbro, LEGO and others continue to blur the lines between toys and entertainment. It's a trend NPD sees strengthening.

"More toy companies are taking the initiative to become entertainment companies adding different media to get their brands in front of children," says Frederique Tutt, European analyst for the NPD Group.

LEGO is also expanding its Ninjago range and its LEGO Star Wars universe in 2012, and has unveiled the first results of its partnership with DC Comics.

Vivid will introduce 30 new Moshi Monsters products during 2012, hoping to double the business to £30 million in retail sales.

Character Building added Deadly 60, Ben 10 and Monsters vs. Zombies to its mini-figure based building line this year. It also unveiled the preschool toy line for HIT Entertainment's Mike the Knight, while Sylvanian Families celebrates its 25th anniversary this year.

You May Also Like