Toy Licensing: A €3 Billion Opportunity in Europe

Toys are the largest licensed category of products for children in Europe and for the first time, NPD EuroToys is looking at licensing in the toy category across nine European markets through point-of-sale data. Tracking data in

April 6, 2018

Toys are the largest licensed category of products for children in Europe and for the first time, NPD EuroToys is looking at licensing in the toy category across nine European markets through point-of-sale data. Tracking data in France, Germany, Italy, Spain, Portugal, Austria, Poland, the U.K. and Belgium has revealed that toy licensing was worth more than €3 billion in these countries in 2009.

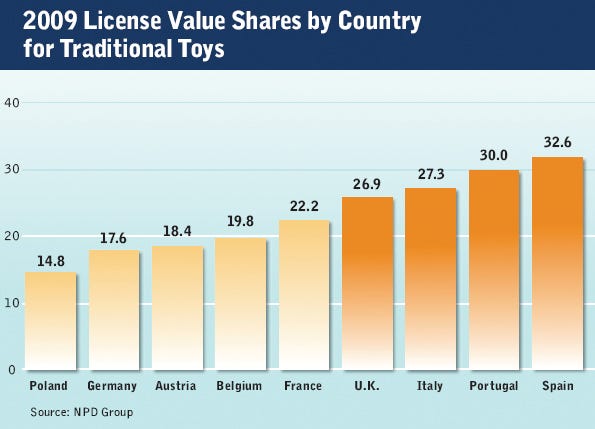

Europe, according to these nine countries, divides into two groups of consumer preference. One comprises the license-driven countries of Spain (at the top), Portugal, Italy and the U.K., which thrive on character toys. The other comprises the brand-driven countries of Germany, Austria, Poland, Belgium and France, which show a tendency toward key toy brands. Each group represents about 50 percent of total licensed toy sales.

The largest market for licensed toys remains the U.K., despite the demise of Woolworths and a troubled 2009. France has a small penetration of licensing—just over 22 percent—but its total toy market is nearly the same size as the U.K., which indicates a big opportunity for licensors.

The year started well for the toy category. The toy market is up 5 percent and licenses account for more than a fifth of sales again. Characters have seen growth of 1 percent in value terms for the first six months. The second half of this year is likely to be stronger than the first thanks to more high-profile films being launched.

Since the beginning of July, many in the toy business have been keeping an eye on the performance of Toy Story 3 and its much-anticipated impact at retail. Once again, Europe is proving that it is not one country with one consumer. Toy Story 3 has so far been very strong in the U.K. where the build up started as early as March. In the week preceding its release, Toy Story 3 was already the No. 1 character across all toys. But in Germany, for example, Toy Story 3 is not a major focus and although it will get a reasonable amount of business, expectations are minimal. At the end of June, German toy sales related to the film were about 11 times smaller than in the U.K.

When NPD looks at current market leaders, global characters dominate the scene with very few local licenses reaching great heights, or extending beyond their own national borders. The U.K., Italy and Spain are probably the three countries most open to new properties, and where global licenses can pick up fast and strong, as Bratz's early success showed in Spain, and Caillou (Ruca) and Winx have in Italy. In the U.K., strong local intellectual properties mean that about 30 percent of the U.K. license market is home-grown. From the Teletubbies, Tweenies and Bob the Builder, to the more recent Peppa Pig or Fifi and the Flowertots, there are numerous examples of successful British licenses. But in spite of domestic success, they rarely manage to perform as well abroad as they have at home.

Will this change? Concentration within the media may well push the business toward a more global entertainment market, but other factors such as toy distribution and the supply chain may also impact licensing in the next few years.

NPD analysts see a chance for the development of more private-label licensed toy products. The emergence of the grocery sector as a huge force within the traditional toy market in Europe may well extend to direct-to-retail deals with the biggest entertainment companies. Direct-to-retail is not new and is well established in some countries in categories such as apparel, for example, but traditional toys have been pretty much ignored so far. The question is, for how much longer?

You May Also Like