Trends and Insights

Trends and Insights

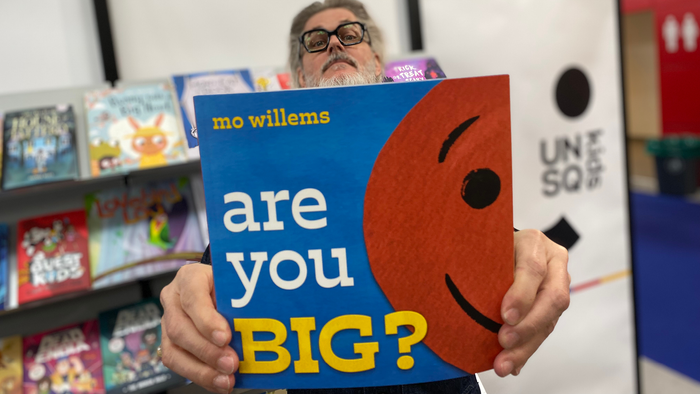

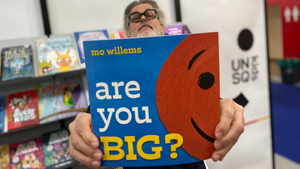

Ezra S. Ashkenazi, Cool Brands

Trends and Insights

10 Minutes With … Cool Brands on Building a Successful Startup10 Minutes With … Cool Brands on Building a Successful Startup

Ahead of Licensing Expo, License Global spoke with Ezra S. Ashkenazi, founder and chief executive officer, Cool Brands, about the company’s plans for its first Licensing Expo.

byIan Hart

Subscribe and receive the latest news from the industry Article

Join 62,000+ members. Yes, it's completely free.