The National Retail Federation has released its 19th annual Top 250 Global Powers of Retailing report providing a look at the world’ largest retailers and e-retailers.

April 6, 2018

Walmart remains on top, while Walgreens bumps Target out of the top 10.

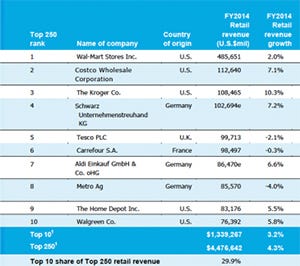

The National Retail Federation has released its 19th annual Top 250 Global Powers of Retailing report providing a look at the world’ largest retailers and e-retailers. Topping the list of 250 retailers were Walmart, Costco, Kroger, Schwarz, Tesco, Carrefour, Aldi, Metro, Home Depot and Walgreens, in order.

The National Retail Federation has released its 19th annual Top 250 Global Powers of Retailing report providing a look at the world’ largest retailers and e-retailers. Topping the list of 250 retailers were Walmart, Costco, Kroger, Schwarz, Tesco, Carrefour, Aldi, Metro, Home Depot and Walgreens, in order.

The report also found that the world’s 10 largest retailers–five of which are U.S.-based and five headquartered in Europe–have a much bigger global footprint compared with the Top 250 overall. On average, the top 10 had retail operations in 16.7 countries, compared with 10.4 countries for the rest of the Top 250. Additionally, nearly one-third of the top 10’s retail revenue came from foreign operations. Schwarz, Carrefour, Aldi and Metro all depended on foreign markets for the majority of their sales. Kroger was the only single-country operator among the top 10 in 2014 (Kroger’s acquisitions of Harris Teeter in 2014 and plans to add Wisconsin-based Roundy’s to its supermarket roster helped the company move to the third place spot from its previous sixth place spot in 2014). Meanwhile, Tesco moved ahead of Carrefour on the list because of the British pound’s strength compared to the euro.

One major change to the top 10 list comes at the number 10 spot with Walgreens. The company, which placed ahead of Target (number 10 in 2013), had a boost in sales among aging baby boomers and newly insured customers. Walgreens also created a $100 billion-plus behemoth in 2015 after acquiring Alliance Boots in December 2014. In upcoming years, Walgreens will vie for a spot near the top of the list if there is its acquisition of Rite Aid gets regulatory approval.

In addition to the top 10 retailers, the report highlighted falling revenue growths in Europe and slowing revenue growth in Asia and Latin America. According to the report, retail revenue growth fell to a five-year low for European retailers in 2014 as 30 percent of the region’s top 250 retailers experienced negative sales growth. Other companies saw their rate of growth decline, but remain positive. However, the composite 2.1 percent year-over-year growth rate in Europe was the slowest since 2009 and the lowest of the five geographic regions.

The report also highlighted the Fastest 50 Retailers, based on compound annual revenue growth over five years. From 2009 to 2014, the composite retail revenue for the 50 fastest growing retailers grew at a compound annual rate of 20.6 percent, more than four times faster than the rate for the Top 250 as a whole. Topping the list was Chinese e-retailers Vipshop, an online discount retailer, and JD.com, China’s largest e-retailer selling electronics and home appliances through a third-party e-marketplace. In addition to Vipshop and JD.com, six more Chinese retailers ranked in the Fastest 50.

You May Also Like