]> 'A retail exclusive is par for the course with a top licence nowadays.' This quote from a licensee sums up how prolific and important it is to create exclusivity for retail

April 6, 2018

]>

'A retail exclusive is par for the course with a top licence nowadays.' This quote from a licensee sums up how prolific and important it is to create exclusivity for retailers. 'Exclusive' is the magic word. But, in practise, how effective is it for licensees, licensors and retailers?

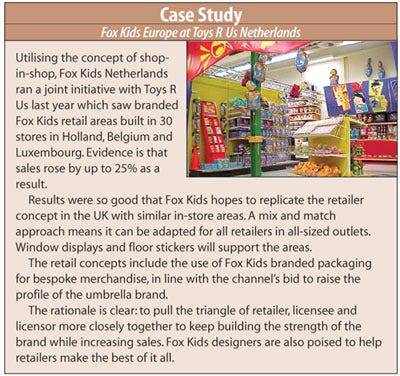

In the USA, where retailers' size gives them mightier buying power than any in Europe, there are increasing instances of retailers taking a licence exclusively in its entirety or in a number of major categories. Toys R Us is the main protagonist, recently being the exclusive retailer for E.T. and Liberty's Kids. 20% of its revenue is made up of licensed exclusives. Walmart's deal with Mary Kate and Ashley is one that has spread across the Atlantic to Asda in the UK.

Across Europe a slightly different picture emerges. The instances of a retailer taking a licence in its entirety are rarer. Rather, there are hundreds of examples of licensees, licensors and retailers attempting to create pockets of exclusivity for retailers without closing any doors of opportunity.

Exclusivity, or offering something no competitor can offer, has become an essential part of high street retailing, particularly in the UK where the retail scene is dominated by high street chains. As one ex-buyer told us, 'Nothing annoyed me more than walking into a competitor's store and finding that it had the same product as we had, possibly at a different price.'

For the retailer, exclusivity has obvious advantages. It can drive sales up and create differentiation in a market that is highly competitive. Many UK retailers now have targets to achieve for the percentage of their offering which should be exclusive.

It is more difficult for independent stores to ask for something individual because they lack the buying power of the multiples. But it could also be argued that independents achieve differentiation in other ways, by being specialist.

The term retail exclusive can refer to a retailer having an exclusive product or line of products and/or exclusive designs and/or an exclusive window of time in which to sell and/or the right to sell all licensed product for a particular property in its entirety, though the latter is rare, particularly for entertainment properties where the categories are so diverse there would be little gained in sticking with a specialist retailer.

The most common exclusives are in category or design with some categories more suited than others. For example, exclusivity tends to be a given with apparel because retailers have exclusive suppliers. It's also common for cards and stationery but is more difficult when tooling is involved, such as for toys.

From a licensor's point of view, giving retailer exclusivity can earn increased marketing and promotional support from the retailer. It's a position to be leveraged to best effect. If it works, retail exclusivity can increase the shopping basket, create a destination in store and have impact on many different levels.

But there are flipsides. Firstly, it limits the brand's exposure on the high street to that one retailer.

Jimmy Neutron, for example, was launched into Woolworth's in the UK, which proved successful on the one hand, but limited consumers' exposure to the character. Secondly, it requires huge efforts on all parts to make it work.

Agency The Licensing Company (TLC) is a champion of finding retailers to work exclusively with different brands. But TLC's Lisa Shapiro cautions that from the initial concept to delivery in store can be a long journey. Whatever the intentions of both parties, there are factors completely out of any-ones' control, such as personnel or strategic changes at head office, that can alter the expectations. If you add this to the challenge of getting all departments of a store group on side or ensuring the hundreds of individual store managers around the country take part you see that, as Lisa says, 'in terms of attention to detail, no stone must be left unturned.'

TLC is even taking the step of developing incentives for individual store managers for its next retail exclusive. This will hopefully encourage individuals focused on weekly sales figures to feel more involved than being at the end of an order from head office.

Retail exclusives with the right retailer can drive an occasion or a point within a brand's life. Fox Kids is planning exactly this with a UK retailer later in the year to mark the 10th anniversary of Power Rangers. But the associated risk is alienating other retailers.

On the subject of exclusivity it seems that licensors steer a careful path, weighing up the pros and cons and ultimately aiming to make each major retailer feel special without upsetting others. Exclusives must be handled very sympathetically, and can often lead to a trade off between retailers.

From the licensees point of view exclusivity can only work if the investment required to provide bespoke products and the volumes ordered by the retailer are viable. If the two add up, it's a useful tool for the licensee and retailer; both can make the most of the message 'this is only available here'.

Vickie O'Malley, retail manager at agency CPLG, suggests that licensees do well to collaborate to produce an exclusive product. For example, greeting card licensee Portico and gift licensee GOSH collaborated to create a Mr Men gift set for WH Smiths, the UK stationery chain. The combination of plush with a mug was attractive to the retailer even though neither plush nor house wares have a place in store. As a gift it was appropriate, particularly with a publishing led licence.

Stationery licensee Blueprint anticipates that exclusive licensed and unlicensed lines will be a substantial percentage of its business in 2003. 'It's becoming more and more prevalent to ask for exclusivity and the requests get more strident. We are always responding with exclusivity of some sort, in terms of time or design,' says managing director Mike Redfern.

There aren't many stationery retailers that can handle the volumes necessary for an exclusive line. However, stationery lends itself to bespoke lines if there is enough visual material to work with to make, for example, up to three ranges each year for a retailer like Woolworth's or WH Smiths.

Creating an exclusive is one thing. Making the most of it is another. If the retailer doesn't support and market the exclusivity then it can become a wasted opportunity (worse is if the retailer uses it to beat the supplier over the head). The project should be a 'win win' scenario.

For retailers the challenge is in leveraging the exclusivity with the time and budget available. Many emphasise it with in-store theatre, character appearances or local publicity.

Other retailers use exclusivity to drive people into the store. At Christmas, for example, manufacturers such as Hasbro make special products (such as gift sets) for a particular retailer, which are then supported with top line advertising. An advert, which can legitimately say: 'Come to us for this product', can actually drive people into the store. As long as the volumes are high, it can be a good result for the licensee as well.

The consensus is that there is a time and a place for retail exclusives. For example, the Vivid Imagination toy line for Care Bears was launched into the UK high street chain Woolworth's in late December 2002 giving it an exclusive window of a few weeks before the products rolled out elsewhere. It might have been a challenge to market the point of difference in such a short window, but it was still an advantage to the retailer and sales are reported to be very good. Because of the ways and times different retailers take in stock for the new season, Woolworth's are poised to take advantage of exclusives at this very particular time of year.

But there is no single solution for every retailer. After all, retailers have a distinctive customer profile and what motivates their customers is different. For example, in the UK Woolworth's attracts high footfall with customers often looking for a bargain. Positioning and standing out are crucial. At catalogue-led retailer Argos, the page design is more critical, and Toys R Us purchases are usually preceded by a car journey to an out of town store; a more pre-meditated exercise. There is so little dissemination of information around the retail culture in general that licensees and licensors must work very hard to understand as much as they can.

In France and other countries whose retail scene is dominated by hypermarkets, exclusivity isn't necessarily as important an objective. Hypermarkets tend to have a mixed offering as a priority. Up to 80% of sales are grocery with clothes and other products helping to draw customers in; they don't tend to focus on just one brand.

However, specialist retailers are catching onto the idea. CPL France executed a retail exclusive with the teenage fashion retailer Pimkie for a line of Buffy the Vampire Slayer-inspired clothing. Pimkie has over 400 shops, visited each day by an average of one million young women aged 12 to 25. In general terms, French consumers aren't well inclined to wear apparel blasted with their favourite chacacters. So the phrase 'inspired by' was crucial; the Buffy branding was evident only on swing tags and in window displays. But the association was clear. It was Pimkie's first exclusive licence and the range sold out in three weeks leading to a complete restock. It lasted for four months and spread to the Benelux countries, Italy, Portugal and Spain.

Although the Pimkie deal was a huge success, CPL France's managing director Marina Narishkin sums up, 'We are building on the number of retail exclusives, but it's not necessarily the way forward for all French retailers.'

You May Also Like