Pet products offer a big growth opportunity for both human consumer products manufacturers and retailers in all channels of distribution Valued at approximately $44 billion in 2006, the overall market for pet products an

April 6, 2018

Pet products offer a big growth opportunity for both human consumer products manufacturers and retailers in all channels of distribution

Valued at approximately $44 billion in 2006, the overall market for pet products and services is expected to post a 7.1 percent compound annual growth rate during the 2003 to 2009 period. Households earning $70,000 or more almost tripled their share of the aggregate pet food expenditure from 1994 to 2004, from 15 percent to 44 percent, while going from 21 percent to 43 percent in the "pet purchase/supplies/medicine" category, according to Packaged Facts estimates based on Bureau of Labor Statistics Consumer Expenditure Survey (CES) data (1994, 1999, and 2004). While some of this growth is the result of an increase in the number of upper income households, it also signifies the success of marketers in tapping into pet owners' desire to pamper their pets by providing them with the best products available.

Among the most important premium pet product demographics are couples without children as they are more likely to purchase more expensive pet products and services because of the attention and discretionary income freed up. The percentage of two-adult households without kids that own dogs or cats rose from 50 percent in 2004 to 55 percent in 2006; more specifically, the percentage of DINK (dual-income, no kids) couples with dogs or cats jumped from 59 percent to 65 percent, and the percentage of empty nesters with dogs or cats rose from 42 percent to 47 percent.

Many of these consumers are taking their pets to work and on trips. Pet owner surveys conducted by the American Animal Hospital Association indicate that more than two-thirds (67 percent) of pet owners travel with their pet, while 43 percent have taken their dogs to work, 42 percent have traveled out of state with their pets, 40 percent take their pets on errands, and 37 percent bring their pets to work once a month. Supporting this trend is the surge of pet carriers, leashes designed for hands-free dog-walking while jogging, pet backpacks for use on bicycles and scooters, strollers for young and senior pets, and apparel and accessories designed to protect pets from the elements.

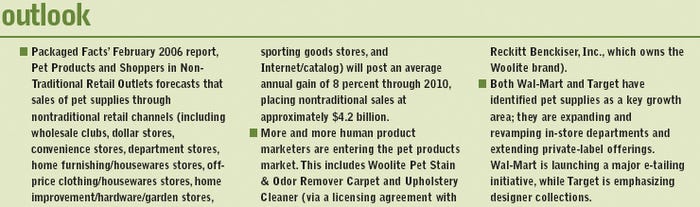

Sales of pet products via the Internet are growing significantly faster than through any other channel, Packaged Facts estimates, with sales forecast to approach $1 billion by 2010. On the brick-and-mortar front, PetSmart and Petco had approximately 1,550 stores in operation and estimated sales of $5.4 billion at the end of 2006, with expansion plans for at least 100 new store openings a year going forward. In addition to focusing on high-margin services, both chains now are beginning to emphasize pricier, boutique-style fare including travel and convenience products.

You May Also Like