The 2011 BrandZ report on the Top 100 most valuable brands showed clearly the importance of brand recognition as companies worked to overcome the economic challenges of 2009. Despite the slow 13 percent growth rate for the ov

April 6, 2018

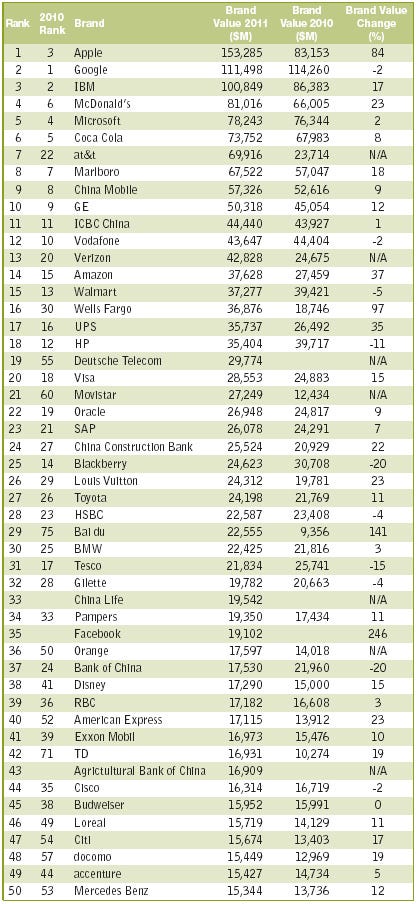

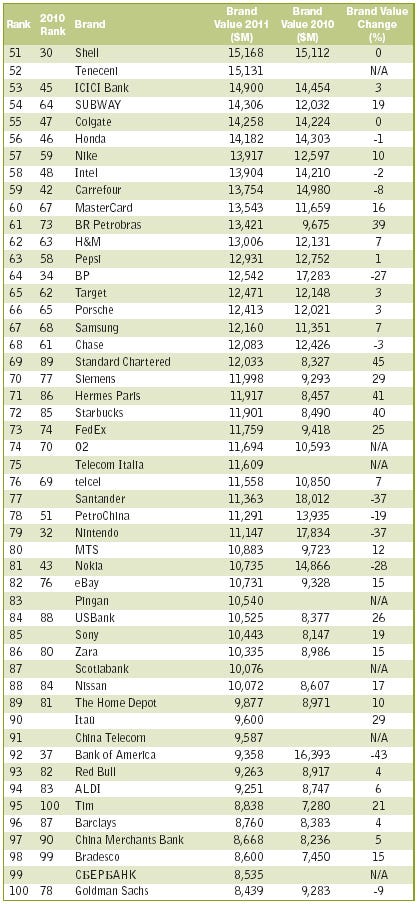

The 2011 BrandZ report on the Top 100 most valuable brands showed clearly the importance of brand recognition as companies worked to overcome the economic challenges of 2009. Despite the slow 13 percent growth rate for the overall economy, the best brands grew in value at a rate of 30 percent, which is a 17 percent increase over 2009, according to the BrandZ report.

Brand recognition clearly paid off. The combined value of the BrandZ Top 100 list is $2.4 trillion, which is greater than the GDP of Great Britain, according the BrandZ editors. The value of the No. 1 brand, Apple, was $153.3 billion, a rise in value of 84 percent and total value equivalent to the GDP of Peru.

Technology brands fared slightly better in 2010 because of capital investments by business, according to the report. In addition, tablet computing stimulated growth for brands like Apple as well as telecommunications brands.

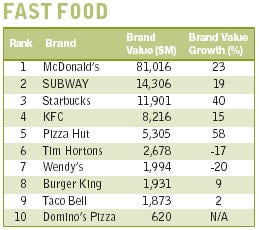

Other brand categories that experienced significant increases were fast food, which grew 22 percent; luxury, which grew 19 percent; and technology, which gained 18 percent in value. A dramatic spike in value, however, pushed insurance to first place because results included three large, expanding Chinese companies.

Compared with 2008 pre-recession levels, the BrandZ report found that the Top 100 brands increased 24 percent since the 2008 stock market crash, adding $500 billion in value since 2008. Milward Brown reported a total increase in the value of the Top 100 brands of 64 percent since the first BrandZ report was published.

The Changing Market

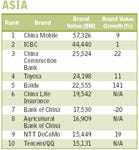

Emerging markets saw a significant increase in representation in the 2011 BrandZ report, which included 12 Chinese brands, three Brazilian brands, one Indian brand and one Russian brand. In addition, the editors reported that two Indian brands narrowly missed the Top 100, but rank in the Top 20 most valuable technology brands.

Spending increased over last year, according to the BrandZ editors, but consumers didn't spend frivolously. In addition, consumers were empowered to find the best products and prices by using mobile devices while shopping in brick and mortar stores. In response, brands invested in social media programs that included Facebook sites, YouTube videos and mobile apps, attempting to cultivate the loyalty of consumers in their teens and 20s.

New media provided the top brands with a window into the concerns and preferences of consumers. Significant trends in the marketplace that had value to the top brands include assertion of individuality, concern for personal health and wellness, concern about the environment and concern about how products are produced. Consumers weren't willing to spend indiscriminately for environmentally-friendly products, but "green" became a decision-making factor in some product categories.

Standout Performers

In addition to Apple's significant jump in brand value, three companies exceeded expectations with significant increases in value on their own and in comparison to other brands.

Most notably, newcomer Facebook entered the BrandZ report at No. 35, experiencing a 246 percent rise in brand value to $19 billion.

In a surprise upset, online retailer Amazon surpassed brick and mortar retailer Walmart to become the No. 1 retail brand, the BrandZ editors reported. Amazon experienced a 37 percent rise in brand value–a total value of $37.6 billion. Since founding the company in 1995, Amazon founder Jeff Bezos has worked to increase the web site's offerings, peer reviews and build loyalty through its delivery.

Chinese search engine Baidu boasted another significant increase in brand value by 141 percent, bringing its total value to $22.6 billion. To reflect this significant growth, BrandZ editors increased the company's ranking from No. 75 to No. 29. China's 1.3 billion citizens drove Baidu's popularity because the brand has deeply understood the nuances of China's diverse cultures and languages.

The Starbucks brand rose 40 percent in brand value based on revitalization efforts initiated two years ago by Howard Shultz, chief executive officer. In addition, the IKEA home furnishing brand grew 28 percent.

Despite its February recall of certain models due to sudden acceleration, Toyota returned to its No. 1 rank in the car category.

Newcomers

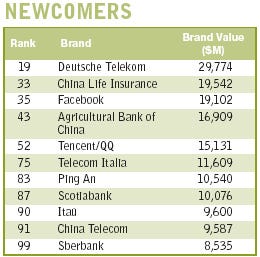

Chinese companies dominated the newcomers list with almost half of the six financial institutions and five telecom and technology brands that made the BrandZ newcomers list. Russian bank Sberbank and Brazilian bank Itaú both made the ranking for the first time.

The increase in telecom providers in part reflects the editor's change in their valuation method, which now includes all components of a brand's businesses: landlines, cable, wireless mobile and Internet.

Scotiabank, also known as Bank of Nova Scotia, did well in the Canadian market, but also operated in 50 countries, including the fast-growing markets of Asia and Latin America.

Apparel Brands

Mid-range apparel brands experienced the slowest recovery in 2010, according to the BrandZ editors. Price categories that did well were low-cost brands with perceived quality and premium brands.

The Ralph Lauren brand gained 18 percent by offering its classic look in many sub-brands and a wide range of price points. Zara rose 15 percent in brand value, particularly in Asian markets. H&M rose 7 percent in value, due to aggressive digital marketing campaigns.

Chinese apparel brand MetersBonwe ranked in BrandZ's Top 10, the first time a Chinese brand has made the ranking. The Japanese Uniqlo brand and German Hugo Boss brand also made the ranking.

Retail Brands

Online retailer Amazon became the world's most valuable retail brand, ahead of Walmart, the world's largest brick and mortar retailer.

The ascent of Amazon, which rose 37 percent in brand value, demonstrated the strength of the digital impact purchasing decisions. Mobile devices gave consumers immediate information about competitive pricing and nearby retailers. In addition, group purchasing sites provided competing incentives.

Technology affected the way that consumers shopped in the recession. Hard discounters like ALDI and Lidl did well, but not as well as might be expected because of competition. Carrefour lowered prices and opened new, more convenient smaller stores in Europe.

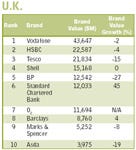

In the U.K., Tesco remained among the global leaders in value, but currency fluctuations somewhat impacted the actual valuation. Walmart tried to re-assert price leadership after alienating some of its U.S. customer base by reaching for affluent consumers. Target combated the high-price perception of its trendy approach to discount retailing by expanding food selection to drive shopping trips and increase sales.

Best Buy struggled despite the closing of Circuit City more than a year ago. Costco sales went up. Ikea's brand value increased 28 percent, while Home Depot's went up by 10 percent. Shifting away from its online auction roots, eBay simplified its site and enjoyed a brand value rise of 15 percent.

Department stores experienced mixed results. Marks & Spencer had difficulty with fashion sales. Mid-priced Kohl's increased sales and margins. Results for Safeway, a supermarket brand, improved with the economy, but rising food costs hindered profits.

The largest global brands continued their expansion into China and other fast-growing markets. Carrefour consolidated many of its banners under the Carrefour brand. Walmart's agreed to purchase the South African retailer Massmart, a development that eventually could change retailing and help elevate living standards throughout Africa.

Digital Ruled

The rankings show an undeniable change in the marketplace. Technology brands are dominating the Top 100 ranking. As important as their financial impact, according to the BrandZ editors, is how these brands have changed the path and speed that delivers information from companies to consumers.

Last year, brands reached customers on brand and retailer web sites, on Google and other search engines and on mobile apps that rewarded shoppers for interacting with brands. Now instead of targeting advertising campaigns to specific demographics, advertisers are engaging consumers across demographic categories with information.

For example, Pampers launched an iPad app titled "Welcome Baby" that illustrated fetal development and helped parents understand pregnancy, allowing consumers to self-identify with their brand and control their brand interaction.

Maintaining this type of digital relationship with the customer depends on transparency and trust from both sides, brand and customer. The quality of the brand/consumer interaction online is now determined by the quality of the digital content.

Digital's impact on shopping soon will intensify further as 4G becomes more widely available and mobile devices continue to offer greater sophistication for less money. Brands are challenged to adapt in the digital world.

You May Also Like