By common consent, "conservative but getting less cautious" is how the French licensing market is described right now. France is home to Carrefour, the world's second largest retail group, is the second large

April 6, 2018

By common consent, "conservative but getting less cautious" is how the French licensing market is described right now. France is home to Carrefour, the world's second largest retail group, is the second largest economy in Europe and it's the nation that created "chic." But the current economic climate is spawning a double-edged trend in consumer products: low-risk attraction to the staple movie franchises and classic properties, combined with a fresh and optimistic requirement to innovate and get creative with new brands.

Well-established broadcasters, entertainment companies and agencies that manage successful classic campaigns for properties such as Peanuts, Hello Kitty and Star Wars dominate the licensing industry in France. Licensing exists at all points on the retail spectrum. The distinctive Paris boutique, Colette, for example, has hosted capsule collections by licensing stars such as Barbie and Ken. Big brands feature in the mass market too. France's third biggest supermarket, Systeme U, stocks a 200 sku Looney Tunes Active direct-to-retail food line.

But France has always had a more considered relationship with character merchandise and if you venture to a quiet rural corner of the country the number of licensed products you find is in stark contrast to that in the U.S. or the U.K.

NPD Group charts the French licensed toy market and there are a number of encouraging trends emerging. According to analyst Frederique Tutt, the French market's 2 percent growth in the first quarter of this year (same as the U.K.) is driven by the independent retail sector, rather than grocers, and by price points above €10 Euros. As in other parts of Europe, building sets and plush have experienced strong growth thanks to brands like LEGO and Zhu Zhu Pets. Hello Kitty remains the top licensed property–it was top across the whole of Europe last year–but Tutt suggests that many retailers will back the next installment of the Cars movie franchise this year, helping to drive it to the top spot.

"Cars is already known here," says Tutt. "It's been strong since 2006. It's started the year at No. 3 and is likely to become the strongest license during 2011."

Marina Narishkin, managing director for licensing agent CPLG in France, told License! Global that despite the economy, there are interesting retail ideas being put on the table.

"We have had retailers meeting with us to discuss some very innovative ideas recently," she says. "Toys 'R' Us, for example, wants to be more proactive with its catalog business and wants to do more with licensing in-store. Fnac and Virgin are looking at their licensed offerings. And the hypermarkets like Carrefour and Auchan are continuing to support licensing. If you have the 'right' rights at the moment, it is possible to get through this difficult time."

Online shopping is growing in France with significant recent arrivals such as Toys 'R' Us. Sites like this could change the toy retail landscape, competing with the grocers on both price and range.

For CPLG the "right rights" are classic properties and big movies. 2011 and 2012 are great years for both with Cars 2, Transformers: Dark Side of the Moon, Ice Age: Continental Drift and Madagascar 3 on the calendar. The Ice Age property in particular is a huge hit in France as it is elsewhere in continental Europe, and next year's movie is already attracting interest from partners.

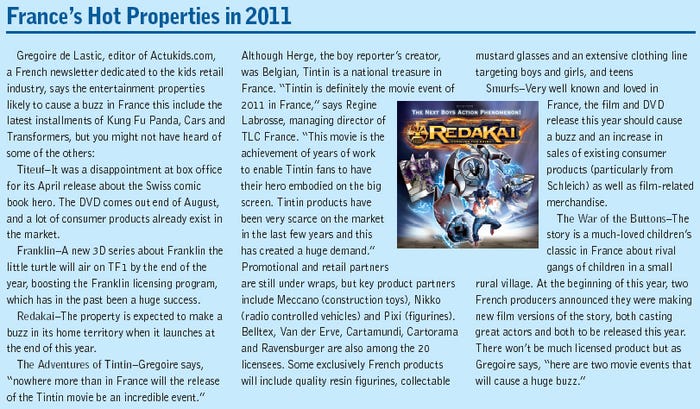

The TV licensing landscape is still dominated by boys' properties and Narishkin cautions how competitive this area is becoming. Beyblade has made a strong start in France, appearing at number two in NPD's chart for the first quarter. Beyblade is one of a number of properties fueling the collectable market, which is strong in France across all categories with good representation in grocers and independent channels. Later this year, Marathon Media, in partnership with Spin Master, launches its new boys' property Redakai for TV and trading cards in the U.S., Canada and Europe. Expectations are high and Patricia de Wilde, Marathon's director of licensing, says the challenge in launching a new property right now is to be more marketing orientated and to put more effort and energy into every aspect of the property.

"There is room for us to be successful. We are being very creative in our promotions and communications and keeping close to the licensing community," she says.

As in other territories, commentators express a lack of girls' brands, although the collectible toy brands like Zoobles, Squinkies and Littlest Pet Shop are all growing well. Hello Kitty and Disney Princess remain strong, and Strawberry Shortcake is being re-launched into the girls' space by CPLG.

One year ago the French licensing industry formed a new association, Federation Francaise des Droits Derives (F2D2) with de Wilde at its head.

"It's always good news for an industry to feel the need to organize itself and it's been a good year," says de Wilde.

French licensing awards, industry research and legal and marketing conferences are just some of the initiatives being driven by the F2D2. But, she admits, "it's not easy."

While the economy in France is not as badly hit as Greece or Spain, the tendency is for the market to be shy. As elsewhere in Europe, this market caution is changing the business profoundly. NPD Group figures imply that parents are supporting traditional brands, and that children are backing collectibles.

"We're being more creative than ever and planning some very interesting new promotions," Narishkin says.

After working with consumer brand partners for Ubisoft's Rabbids, CPLG is approaching new partners on behalf of other brands and pushing the traditional parameters. De Wilde agrees that business is changing–not so much growing as extending, covering more ground, moving in different directions. For example, a number of small agents and consultants are coming into the market with a focus on design and brands, areas traditionally less developed in the French market but starting to build now.

The double-edged trend of risk aversion combined with innovation should have some interesting results for the French consumer over the next 12 months.

You May Also Like